CCA has reproduced the following press release from SGS Economics because we believe that it gives the clearest indication yet that Australia’s “two stage economy” – Sydney/Melbourne, and all the rest – is a significant phenomenon that needs to be addressed urgently by policy makers. The implications for this are profound for Australian regions outside of Sydney and Melbourne (and especially outside the capital cities). Vocational education and training (VET) has an important role to play, and community providers – as we detail in our report on The Role of Community Education Organisations in Regional and Rural Economic Development – are low-cost, high-efficiency means to assist regional economic development. (Sentences in bold below are by CCA.) (Comment published on 3 March 2017.)

*******

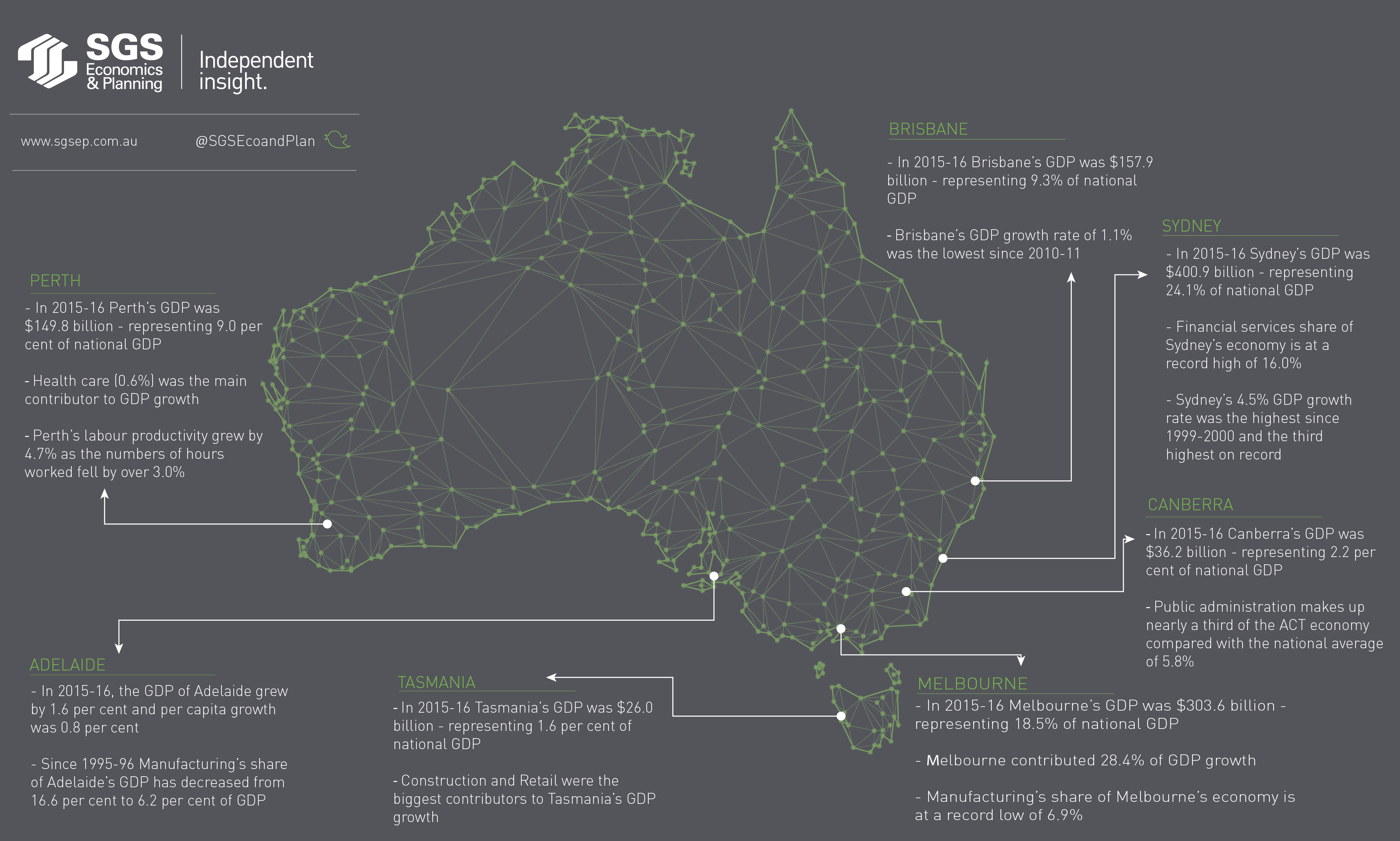

New research released by SGS Economics & Planning (SGS) reveals that Sydney and Melbourne are driving the national economy, while regional areas are languishing. During 2015-16, 67.0 per cent of national Australian Gross Domestic Product (GDP) growth was generated in Sydney and Melbourne – the highest level on record.

Sydney contributed 38.6 per cent of all (national) GDP growth in 2015-16, the highest since 1991-2.

Strength in domestic and global financial markets saw financial and insurance services underpin Sydney’s performance. Financial and insurance services share of Sydney’s economy is now at a record high of 16.0 per cent.

With strong housing starts and a range of infrastructure projects underway, the Construction industry’s contribution (0.7 percentage points) to Sydney’s GDP growth was also the highest on record.

At $80,000, Sydney’s GDP per capita is $10,600 higher than the national average – the highest margin since 2004-05 and $32,200 higher than regional NSW.

Although Sydney is booming, regional New South Wales is struggling. While the GDP growth rate of 0.4 per cent in 2015-16 was an improvement on the 0.0 per cent recorded in 2014-15, GDP per capita has declined in each of the past four years. Over the past decade, Manufacturing production has declined by more than 20 per cent in Regional New South Wales.

Melbourne contributed 28.4 per cent of all Australian GDP growth in 2015-16, the highest on record. Its 3.1 per cent increase in GDP was the strongest since 2010-11 with a broad range of industries contributing to growth.

Financial and insurance services (0.7 percentage points) and construction (0.7 percentage points) were the largest contributors. The construction industry’s contribution to Melbourne’s GDP growth was the second highest on record, driven by apartment construction and infrastructure projects. Manufacturing detracted from economic growth in 2015-16 and its share of Melbourne’s economy is at a record low of 6.9 per cent.

GDP in regional Victoria fell by 1.0 per cent, driven by a sharp decline in Manufacturing. GDP has fallen in each of the past three years and there has been a decline in GDP per capita over the past nine straight years. Manufacturing in Regional Victoria has fallen by over 20 per cent since 2005-06 due to a range of industrial plants closing down.

Brisbane’s 1.1 per cent GDP growth rate was the lowest since 2010-11. Brisbane’s GDP per capita fell by 0.5 per cent to $67,300, the first fall since 2010-11. Regional Queensland’s GDP grew by 2.8 per cent, more than half of which came from increased mining production.

Perth’s GDP growth in 2014-15 of 1.6 per cent was the third lowest on record. Unlike the other major capital cities, the construction industry detracted from Perth’s GDP growth.

In 2015-16, GDP in regional Western Australia increased by 2.3 per cent. Without mining, regional Western Australia’s GDP would have declined.