CCA summarises relevant coverage and opinion on the Commonwealth’s 2020/21 Budget below.

A missed opportunity: “The Government has missed an opportunity to pursue a green recovery, invest in social housing and childcare, and offer more support to those left behind – all strongly supported by most economists. There are also areas needing significant reform, including aged care and health, that were not prioritised. Rather than being a ‘build back better’ budget, this is an unimaginative budget that at best seeks a return to what was a fraying economy, increasing inequality and continuing environmental degradation.” – David Crosbie, Community Council of Australia

Keynesianism for the rich: Liberals unveil a new politics of debt-fuelled individualism: “This is a budget for winners — for the employed, especially those in high-paying jobs, for businesses with cash to spend on investment and more staff, for the industry sectors the government likes, like resources and defence.” – Bernard Keene, Crikey

This is the budget business wanted — “At least, the businesses that are assured of survival and are looking for growth. Whether it is the right budget to get jobs and the economy back to where they were before we ever heard of COVID-19 remains to be seen. [The Government has] rejected the advice of economists on the best way to recharge the economy, and focused instead on trying to recharge it with support to … business and middle-to upper-middle income earners.” Tim Colebatch, Inside Story

Winners and losers: Farmers, gas and mental health win out over aged care, older unemployed, most women and social housing. – Kishor Napier-Raman and Amber Schultz, Crikey

Good ideas: “In an extraordinary, big-spending budget, there were some pretty good ideas – research and development, home care packages, local government road spending, instant write-offs and COVID-19 vaccine.” – Amber Schultz, Crikey

Solid effort followed by disappointment: “Perhaps the Federal Government is exhausted. That would be understandable. But while this is a good budget for this year — and maybe next — it’s not a budget that deals with the considerable challenges facing the Australian economy, which were all too apparent before the pandemic.” – Professor Richard Holden, Crikey

Covid-19 is not a normal recession: While some recessions affect demand (like the 9/11 attacks, which kept US consumers at home) and others affect supply (earthquakes and tsunamis that cripple businesses), Covid-19 affects both. Government lockdowns and the fear of getting sick have kept consumers at home, while the shutdown of supply chains, shortages of workers, the inability to source inputs, and the sudden fall in international tourism, students and migrants have devastated businesses. – Adam Triggs, Inside Story

EDUCATION AND TRAINING

The Government has previously announced (pre-Budget) major subsidies for apprenticeships and trainees, along with a number of other initiatives. (See summary at end of this article.)

WOMEN MISS OUT

High-viz, narrow vision: “This budget overlooks the hard hit in favour of the hard hat. The government should check this blind spot quickly. A broad-based recovery depends on it. The Morrison government seems to think economic stimulus is all about high-viz vests and hard hats. It’s a narrow and dated view of the world of work…. The government has left the biggest opportunity on the table. Making child care more affordable is the most effective way to reduce the gender gap in working life and retirement – directly supporting jobs and the economic recovery. Instead, women seem to have been relegated in this budget to an afterthought in the form of a A$240 million ‘support package’, which offers no meaningful economic support.” – Danielle Wood, Kate Griffiths and Tom Crowley, The Grattan Institute in The Conversation

Workforce participation: “The budget announced $240.4 million in funding purportedly to lift female workforce participation back to pre-crisis levels. But the Women’s Economic Security Statement provides no job creation plan to meet the challenges of women without jobs or who have left the workforce since March. It will not address the structural barriers holding women back from accessing paid work…. Investment in the social infrastructure of the economy – healthcare, education and caring services – should be prioritised as an effective and legitimate industry policy.” – Australia Institute Centre for Future Work

Inherent bias in our economic system: The Budget contains "a fundamental confusion between the concepts of equality and equity. A budget that treats everyone equally, ignoring the fact that women start from a place of significant disadvantage on almost every meaningful economic measure, simply entrenches gender inequality and, in light of the disproportionate impact of the current recession on women, actually risks sending us backwards." - Emma Dawson, Per Capita, in The Guardian Australia

Budget is for women who work, pay tax, run businesses and want jobs, says Prime Minister Scott Morrison – quoted in The Australian.

CCA COMMENT: All up, not-for-profit adult and community (ACE) providers train women proportionately much more than TAFE or for-profit providers: more than two-thirds of ACE students nationally are female, whereas less than half of students in the other provider groups are female.

AGED CARE

Nothing for the aged care workforce: “There is nothing for worker conditions or pay in an industry that’s one of the most dangerously low paid and insecure. Not even funding to increase the number of staff in homes…. ‘The Interim Report noted that the aged care workforce is under-resourced and overworked,’ Royal Commissioners Tony Pagone and Lynelle Briggs wrote in the Covid-19 report, released at the beginning of October. It is now also traumatised…. ‘Instead of another quick fix, I was expecting that the government would use this budget to make a down payment to fix well-recognised inadequacies in residential aged-care staffing,’ [University of Wollongong Professor] Kathy Eagar says.” – Rick Morton in The Saturday Paper.

CCA COMMENT: Many CCA members offer the Certificate III in Aged Care, a qualification that provides important access to jobs for those with lower levels of formal education. The Australian Government’s Job Outlook shows that 56% of workers with Cert III in Aged Care are 45 years or older (average age 47), and 80% of workers are female (average classification 48%), with 177,200 people employed in “Aged and Disabled Carers” occupation (2019 data). It is disappointing that the under-paid aged care workforce and under-resourced aged care sector has not received much-needed a boost.

ECONOMIST PRIORITIES: Social Housing, JobSeeker, Education, Training and Infrastructure

A pre-Budget survey of 49 leading Australian economists nominated four top options for boosting the economy (see image):

- boosting spending on social housing, endorsed by 55%;

- permanently boosting JobSeeker;

- more funding for education and training; and

- infrastructure projects.

Specific comments from the survey:

- Lisa Cameron, Monash University: “Tax cuts are unimaginative policy. They do not take the opportunity that COVID-19 presents. In contrast, investing in infrastructure, including social housing and renewable energy, paves a way for long term growth, while meeting targets other than just purely economic targets.”

- Saul Eslake. Corinna Economic Advisory: “A lot of little infrastructure projects would do more to underwrite sustainable economic recovery than a handful of big ones.”

- Lata Gangadharan, Monash University: “Infrastructural projects and funding for education and training are great (long term) ways to support a sustained economic recovery.”

CCA COMMENT: CCA has long advocated for a national “social infrastructure” program for not-for-profit community providers. Examples of projects from NSW ACE providers show how easy it is to identify opportunities. In 2009, the Commonwealth Government set up a $100 million “Investing in Community Education and Training program”. When CCA surveyed provider recipients a few years ago, we found that more than 100,000 additional students undertook training in the subsequent 7 years as a direct result of that funding, as well as greatly enhanced accessibility for students with disabilities and numerous other community benefits. In other words, one new student was trained for every $1,000 invested, a fabulous return on investment.

JOBS

JobMaker is expected to support around 450,000 positions for young people. The JobMaker Hiring Credit will be available to employers for each new job they create over the next 12 months for which they hire an eligible young job seeker aged 16 to 35 years old.

Adding to debt without greatest job gain: “Although the plan to subsidise the wages of newly employed young people in their first year gets a big tick, the brought-forward and back-dated tax cut that is the centrepiece of this budget is among the least effective ways to create jobs – Ross Gittins in the Sydney Morning Herald

Glimmer of hope but millions left stranded: “While the Budget provides some glimmer for hope on jobs for young people, it comes as a crushing let-down for many others without paid work…. [it] has missed key opportunities for job creation initiatives that would have delivered public good, particularly in female-dominated sectors, instead focussing on projects that will take longer to get off the ground.” – Cassandra Goldie, ACOSS

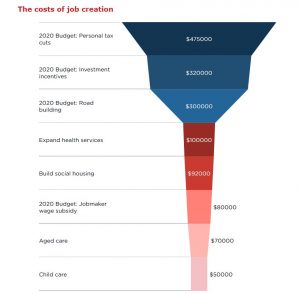

(See ACOSS graphic below - cost per job created by type of expenditure; source: ACOSS website.)

Where are careers: “While ‘jobs’ was mentioned 37 times, the Treasurer didn't mention ‘career’ once in his speech. And there's a big difference between being employed, and being meaningfully employed in a job with enough hours, decent pay and some prospect for promotion or advancement.” – Michael Janda, ABC News

Where the money is directed: Covid-19 has hit the services sector the hardest, but it’s manufacturing that’s singled out for support. Covid-19 has disproportionately affected women, but most budget measures favour men and male-dominated industries. Covid-19 has caused massive unemployment, but it’s the employed who get the tax relief. Covid-19 has caused huge challenges for young people, but funding changes and a lack of support for universities threaten to make things worse for many. – Adam Triggs, Inside Story

*****

APPENDIX: THE COMMONWEALTH BUDGET 2020 – SKILLS INITIATIVES SNAPSHOT

(supplied by the Australian Government Department of Education Skills and Employment)

BOOSTING APPRENTICESHIP COMMENCEMENTS; The $1.2 billion Boosting Apprenticeship Commencements wage subsidy will support 100,000 new apprentices. The Government will pay a 50 per cent wage subsidy to businesses of any size who take on new or recommencing apprentices from 5 October 2020 to 30 September 2021, for wages paid in that period. The subsidy will be capped at $7,000 per quarter for gross wages.

EXTENDING ACCESS TO LANGUAGE, LITERACY AND NUMERACY TRAINING TO ADDITIONAL JOB SEEKERS: The Australian Government will invest $49.5 million to fund 14,485 additional places in the Skills for Education and Employment program to ensure new job seekers who lack basic language, literacy and numeracy skills will be able to access the training and support they need.

EXTENSION OF VET FEE-HELP REDRESS MEASURES: The Australian Government will commit $11.9 million to extend the VET FEE-HELP Student Redress Measures to allow eligible students to apply to have their debt re-credited. The Redress Measures were due to cease on 31 December 2020, but now eligible students will have until 31 December 2022 to apply to have their debt re-credited.

NEW APPRENTICESHIPS DATA MANAGEMENT SYSTEM: The Government will create a new Apprenticeships Data Management System to replace the current outdated apprenticeships information system, known as the Training and Youth Internet Management System. The new Apprenticeships Data Management System will be developed over four phases from 2020-21 to 2023-24 at an estimated cost of $91.7 million.

NATIONAL CAREERS INSTITUTE: The Australian Government will invest a further $29.6 million to support the ongoing work of the National Careers Institute and cement its role, ensuring people have access to authoritative and accurate careers information and are able to actively manage their career pathways irrespective of their age or career stage.

VET STUDENT LOANS TUITION PROTECTION LEVY WAIVER: The Australian Government will waive collection of the 2020 VET Student Loans (VSL) Tuition Protection Levy, providing significant relief for 140 approved vocational education and training providers. The Government will also provide an additional $2.7 million in seed funding to ensure the Tuition Protection Service has sufficient available funds to continue delivering tuition protection to students and the VSL sector.

VET STUDENT LOANS LOAN FEE EXEMPTION EXTENSION: The Australian Government will extend the VET Student Loans (VSL) loan fee exemption for a further nine months to 30 June 2021, providing significant relief for around 21,000 full fee paying VSL vocational education and training students.

SUPPORTING SKILLS REFORM: The Australian Government is investing $75.9 million through the Department of Education, Skills and Employment to support:

- Enhanced Support for School Leavers – a career support service commenced from 1 October 2020, providing school leavers with help to navigate the School Leavers Information Kit and the National Careers Institute’s new digital platform, Your Career. The service will offer a personalised career guidance session with a qualified career practitioner for up to 45 minutes, as needed. Targeted information will also be printed and distributed to help school leavers navigate post-school pathways. A call centre for school leavers will be established to assist in responding to the economic shock to Australia’s labour market.

- JobTrainer fund and development of a new National Skills Agreement – designing, negotiating and implementing the $1 billion JobTrainer fund, and design and negotiation of the new National Skills Agreement.

- Enhanced Industry Engagement and Qualification Development – working on reforms to streamline national VET qualifications, improve industry engagement and continue to trial new ways to respond to employer needs.

- Reforms to Improve the Quality of Training – strengthening quality standards, building Registered Training Organisation capacity and capability for continuous improvement and developing a vocational education and training workforce quality strategy.